The Cape Town Bubble

Topic Category: Economics

Recently, I learned that the City of Cape Town is proceeding with the construction of a R115 million “security wall” along the N2 highway, especially from the airport, which is often referred to as the “hell run” due to the targeting of motorists by criminals. Local residents criticize the city for using this initiative as a distraction from addressing the root cause of the issue: poverty.

The city has recently experienced a surge in complaints regarding a housing crisis exacerbated by a tourism boom. This influx of foreigners, armed with foreign currency, has led to increased property purchases, driven by digital nomads and Airbnb listings that promote short-term rentals, thus diminishing the already limited long-term housing availability. Consequently, property and rental prices have skyrocketed, pushing locals out of the city center and forcing them to reside on the outskirts.

Having lived in Cape Town for several years, I can attest to the city's unique charm. After visiting numerous cities worldwide, it’s clear that Cape Town’s natural beauty—encompassing an ocean, a mountain, a vibrant food culture, and wine regions—all within a 30 km radius, is unparalleled.

However, beneath this beauty lies a looming economic bubble and significant challenges, reminiscent of Miami. Let’s delve into the details.

The Apartheid History of Cape Town

Apartheid spatial planning in Cape Town was a calculated attempt to create a racially segregated environment, a process that intensified after the National Party gained power in 1948.

Key Pillars of Apartheid Spatial Planning

Group Areas Act of 1950: This essential legislation authorized the government to allocate specific urban areas for exclusive occupation by one of four racial groups: White, Coloured, Indian, and Black. Living in areas not designated for one's racial group became a criminal offense.

Forced Removals: Thousands of families were forcibly relocated from central, well-positioned areas to the city’s outskirts.

District Six: Notably declared a "whites-only" zone in 1966, resulting in over 60,000 residents—primarily Coloured, Indian, and Black—being removed and their homes demolished.

Creation of the Cape Flats: Displaced residents were moved to "dormitory townships" situated on the sandy Cape Flats, including Mitchells Plain, Langa, and later Khayelitsha.

Buffer Zones: Physical barriers—such as railway lines, highways, and industrial zones—were established as "buffers" to separate racial groups and discourage interaction.

Inequitable Access: The "historic core" (city center and affluent suburbs) was reserved for Whites, retaining over 80% of the city’s jobs and high-quality services, while non-white townships suffered from a lack of economic infrastructure.

2. Brief History of Miami

Miami’s history is closely tied to the drug trade, which transformed it from a quiet vacation destination into a global economic and cultural powerhouse, fueled by immense illicit wealth and extreme violence.

The Era of "Cocaine Cowboys" (1970s–1980s)

The 1970s marked a significant transition as marijuana gave way to the more profitable cocaine sourced from Latin America.

The Hub: By 1981, Miami had become the entry point for 70% of the United States' cocaine and marijuana, triggering a dramatic real estate boom.

Now, let’s examine the different self-interests influencing Cape Town, starting with an income analysis.

3. Income Analysis

This analysis contrasts Miami, Florida, and Cape Town, South Africa, using projected data for 2025–2026. Miami has a significantly higher cost of living and median income compared to Cape Town. While Cape Town is the most expensive city in South Africa, it remains approximately 50% to 70% cheaper than the USA, particularly regarding rent and services.

1. Median Income Comparison

Income levels vary drastically due to currency fluctuations and local economic conditions.

Miami, FL: The median household income ranges from approximately $59,390 (R953,000) to $66,337 (R1.1 million) per year. To live comfortably, a single adult often requires an income exceeding $100,000 (R1.6 million) annually.

Cape Town, SA: The median household income in Cape Town is around R140,523 per year (approximately $7,500–$8,000 USD at current exchange rates). A "middle-class" salary typically falls between R8,000 and R30,000 per month (around $400–$1,600 USD/month).

Key Takeaway: While Miami's incomes are significantly higher, they are crucial for covering the high cost of living.

2. Cost of Living Analysis

Rent/Housing: Rent in Miami is substantially higher. A one-bedroom apartment in the city center can exceed $2,800 (R45,000) per month. In contrast, similar apartments in Cape Town's city center average around R12,000–R15,000 per month (approximately $600–$800 USD).

Consumer Prices & Groceries: General expenses (groceries, entertainment, services) in Cape Town are generally much lower than those in Miami. The cost of living in South Africa is typically 52% to 70% less expensive than in the USA.

Daily Expenses: While Cape Town is overall more affordable, maintaining a high-end lifestyle (premium dining, private schools, imported goods) can still be expensive. To live comfortably in Cape Town, one needs to earn R30,000–R50,000 or more per month. However, the median monthly income of individuals in Cape Town is R11,500, which is far below the threshold for comfortable living, thus excluding many from the city center.

4. Cape Town Tourism and Digital Nomads

Cape Town is experiencing an unprecedented tourism boom, with 2025 projected to be the city's busiest year to date.

Key Growth Percentages (2025)

Total Airport Passengers: Cape Town International Airport reached a record of 11.1 million two-way passengers, reflecting a 7% increase over the previous record set in 2024.

International Arrivals: International two-way passenger traffic rose by 7% year-on-year, totaling 3.3 million travelers.

Domestic Arrivals: Local travel also experienced a 7% rise, with 7.8 million domestic passengers.

Peak Season Surge: December 2025 witnessed a 10% increase in international passengers compared to December 2024.

Pre-Pandemic Recovery: International arrivals through Cape Town have surged to 21% above pre-pandemic levels from 2019.

Hospitality & Economic Impact

Hotel Revenue (RevPAR): Revenue per available room in Cape Town increased by 15.6% as of mid-2025. Luxury (5-star) hotels experienced even higher gains, with average room rates rising by 17% over 2024.

Occupancy Rates: The city maintained strong hotel occupancy, averaging 74% in the early months of 2025.

Job Creation: The tourism sector now supports over 106,000 jobs in Cape Town, with approximately 1 in 10 bookings directly contributing to local employment.

Air Cargo: The city's role as a logistics hub is highlighted by a 42% growth in air cargo volumes in the first 10 months of 2025.

Top Source Markets (via Air)

The tourism boom is primarily driven by recovery in these key international markets:

United Kingdom

Germany

USA (with a growth of 3% year-on-year)

Netherlands

France

Cape Town has also seen a significant increase in digital nomads, recently ranking 6th globally on the Big 7 Travel 25 Best Cities for Digital Nomads list for 2025.

Key Metrics Reflecting This Growth

Estimated Presence: Although official visa numbers remain low (only 24 official visas issued by April 2025), LinkedIn data estimates around 10,000 remote workers currently reside in Cape Town.

Rental Market Surge: The demand for nomad-friendly housing has skyrocketed, with Airbnb listings in Cape Town soaring by 190% since 2022, totaling over 25,800 active listings—outpacing major cities like Berlin and Florence.

Housing Cost Increase: This influx has led to a 28% annual increase in rent for one-bedroom apartments in prime areas such as the City Bowl and Atlantic Seaboard.

Economic Contribution: Each digital nomad is estimated to contribute approximately $2,700 (± R51,000) per month to the local economy.

This growth has largely been fueled by the introduction of the South African Remote Work Visa, which opened for applications in March 2025, targeting individuals earning at least R650,796 annually.

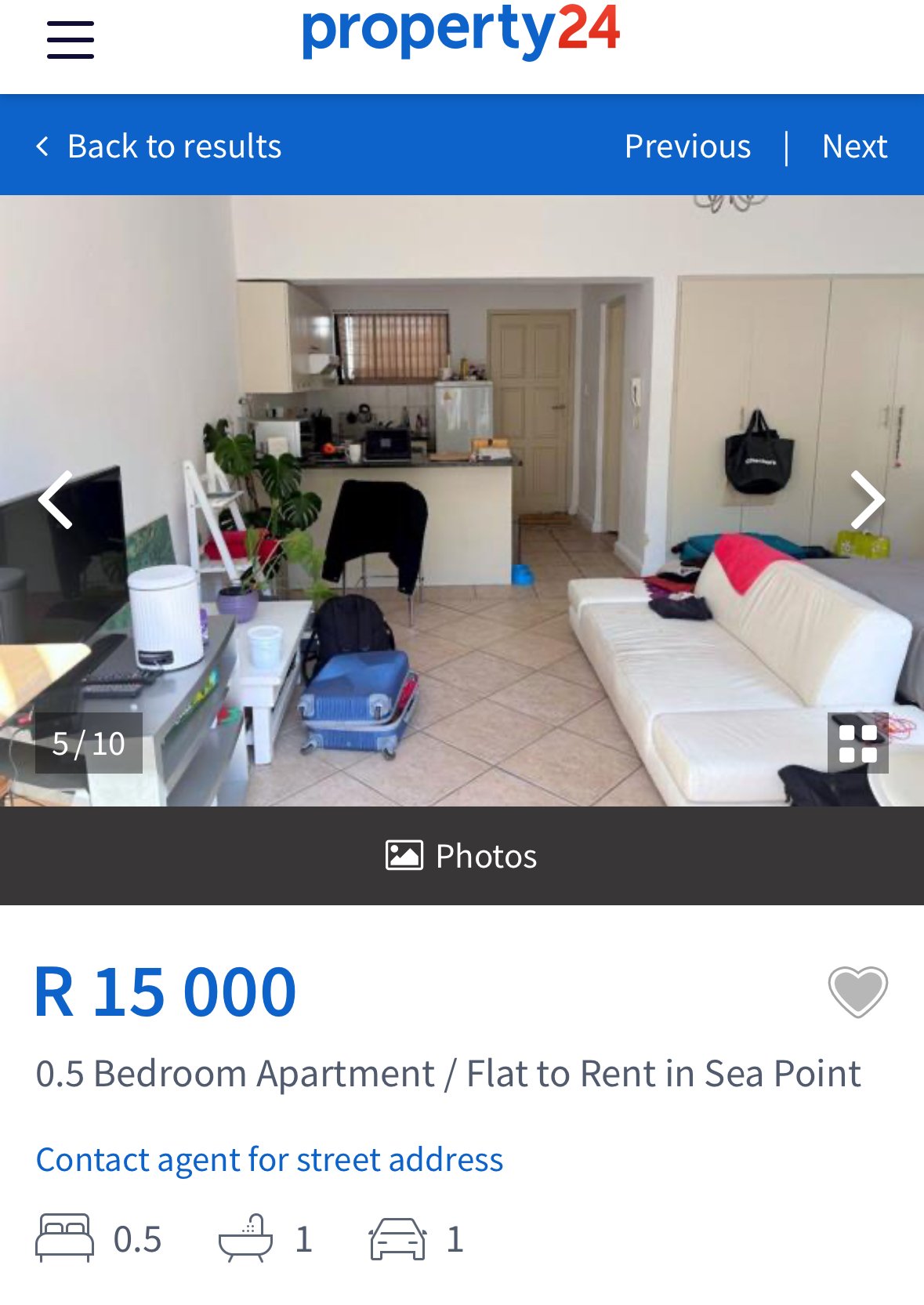

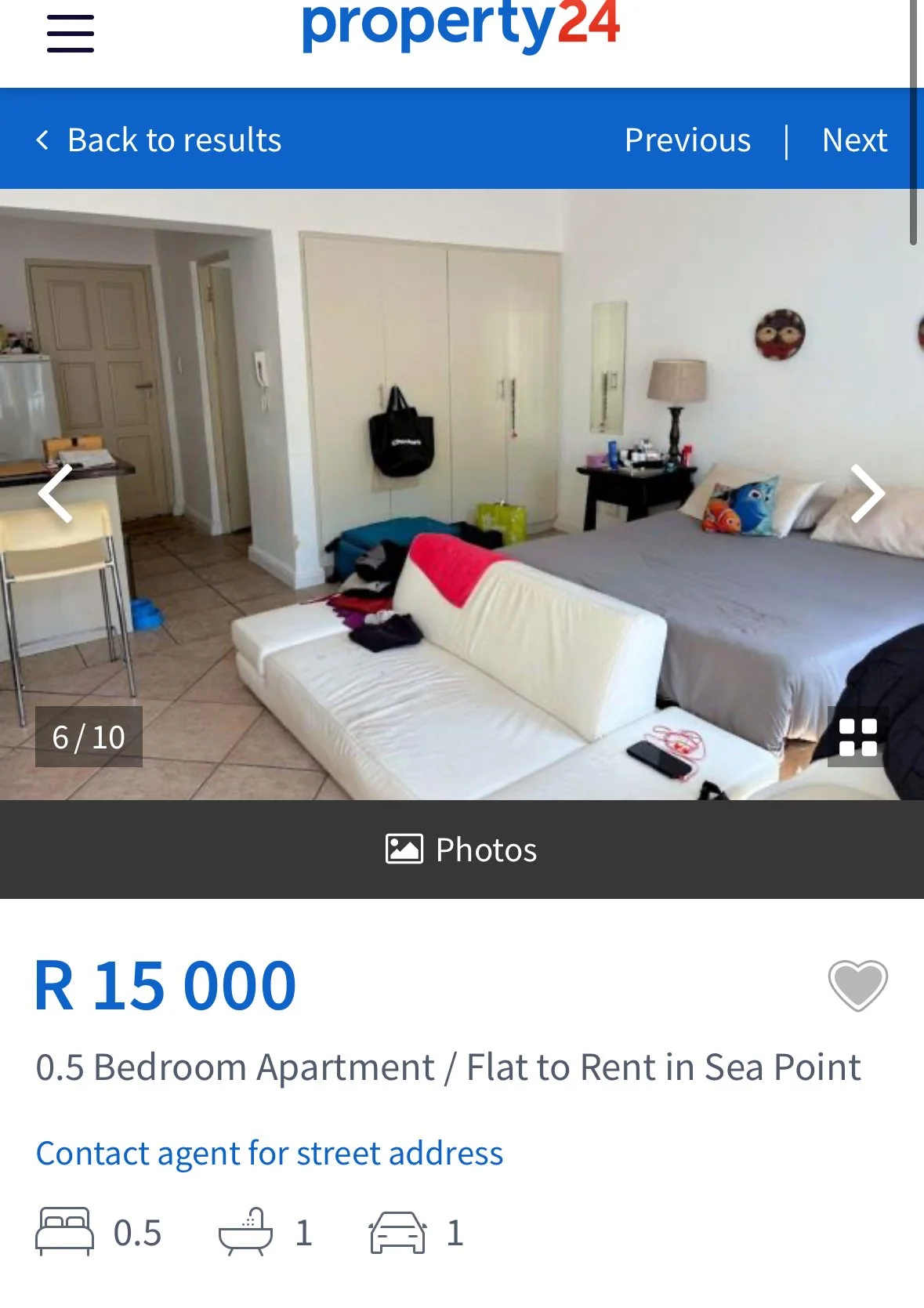

5. Landlords

The growing demand for prime rental spaces in Cape Town, coupled with limited and decreasing supply due to Airbnb, has driven rental prices upward. This trend benefits landlords who own prime properties in the city. Consequently, competition for rental approvals favors foreigners with stronger currencies over locals. Given the median incomes in Cape Town, this results in the economic exclusion of locals from the city, further exacerbating inequality and frustration. Landlords are now offering small rental properties at exorbitant prices as you can see below:

Sea Point rental property

Paying R15K to have your bed so close to your fridge is wild!

6. The Local Experience

Locals earning a median income of R11,500 are increasingly unable to find housing in Cape Town, forcing them to live on the outskirts and endure significant traffic during their daily commutes to the city center. If you’ve lived in Cape Town, you understand the severity of this traffic compared to the Johannesburg to Pretoria route in Gauteng. Additionally, it is noticeable that very few Uber drivers are locals; most are from Somalia or other African countries. As a result, the informal housing and homelessness situations in Cape Town have worsened, contributing to the city's desire to build a wall. The combination of poverty, inequality, and the rise in foreign currencies has created a fertile ground for criminal activity.

7. Organized Crime/Cartel Interests

Cape Town has seen a significant uptick in drug trade activity, driven by the entrenchment of transnational drug cartels collaborating with local gangs. This is evidenced by the luxury vehicles driven by some Nigerians in Cape Town and the proliferation of club businesses in the city, which serve as hubs for money laundering. General Mkhwanazi recently made a concerning statement regarding cartel infiltration into the government, noting that only 10% of shipping containers are searched at the ports. This situation draws parallels to the earlier discussion about Miami, as Cape Town’s port is a key access point to Asian markets. Both cartels and corrupt politicians are effectively running the city.

Recent Trends & Key Indicators

Presence of Global Cartels: International cartels from Mexico, Colombia, the Balkans, and South America have increasingly used South Africa as a critical hub. In late 2025, cocaine seized in the Western Cape bore packaging identical to that of Mexican cartels, confirming their involvement in the region.

Fastest-Growing Markets: Cocaine has emerged as the fastest-growing criminal market in the country since 2019. Additionally, the trade of synthetic drugs has accelerated rapidly since 2023, with Cape Town serving as a primary hub for consumption and trafficking, driven by the influx of foreign currency users seeking access to drugs.

Rising Violent Crime: The Western Cape recorded a 9.1% increase in murders (1,160 total) from July to September 2025 compared to the previous year. Experts largely attribute this to gang-related turf wars over drug distribution networks.

Operational Impact

Police Resource Strain: In early 2026, South Africa's Acting Minister of Police admitted that the SAPS is overstretched and currently lacks the resources to combat the scale of organized crime in the Western Cape effectively.

Infrastructure & Trafficking: Cape Town’s port and international airport remain high-risk entry points. In 2025, major busts included R252 million worth of cocaine seized at Still Bay and multiple arrests of foreign nationals linked to clandestine drug labs.

Transnational Hub: South Africa is now ranked first in Southern Africa and second on the continent for criminality on the 2025 Africa Organized Crime Index, specifically highlighted as a transit point for heroin and methamphetamine bound for East Asia and Europe.

8. Government (DA) Interests

In 2026, critics and opposition parties assert that several Democratic Alliance (DA) policies and interests in Cape Town prioritize international investors, affluent non-residents, and the optics of a "world-class city" over the immediate needs of local residents. These policies help maintain the DA's power by showcasing increasing tourism, which boosts city income, despite a lack of focus on local residents.

Specific Interests and Policies Not Serving Locals Include:

Digital Nomad and International Tourism Support: The DA has actively advocated for a "Digital Nomad Visa" and supported the growth of short-term rentals like Airbnb. While this bolsters the local economy, critics argue it has exacerbated the housing crisis by allowing foreign buyers and tourists to outbid locals, effectively displacing residents from the inner city due to soaring rents.

Rejection of Emergency Local Relief: In January 2026, the DA-led council voted against a motion to establish a dedicated Disaster Relief and Contingency Fund. Opposition groups argue this fund would have enabled more rapid and dignified responses to the frequent seasonal fires and floods that leave local families in informal settlements homeless.

Fixed Service Charges and "Bracket Creep": Residents have protested multiple "fixed charges" for water and electricity. Critics claim these charges are exploitative as they are linked to property valuations rather than actual usage, penalizing locals in gentrifying neighborhoods who may be "asset-rich but cash-poor."

Spatial Planning and Land Sales: The city often faces criticism for auctioning inner-city land to private developers for "urban renewal" instead of using it for social housing. Activists argue this perpetuates "spatial apartheid," keeping the working class in underdeveloped peripheral areas like the Cape Flats while the urban core serves high-income investors.

Infrastructure for "Optics": While the DA highlights its multibillion-rand infrastructure spending, critics point to significant underspending—approximately R1.2 billion in housing funds—and contend that current projects prioritize creating a "Little Europe" for tourists rather than improving basic services like sewage and safety in townships.

9. The Future

The interplay of criminal interests, the DA's need to retain power, and landlords' desire for higher rents overshadow the interests of powerless locals, who must grapple with rising inflation across the board. This situation is likely to lead to some form of revolt, not because I wish for it, but because it seems inevitable when the common person feels increasingly marginalized and frustrated. I often recall how, during COVID, it was the locals who sustained businesses when tourists were absent. How quickly we forget.

Cape Town is in a precarious situation, and the DA will face a reckoning if they do not aggressively implement policies that prioritize local residents. The city has long since ceased to belong to its locals.

While I hope my predictions are incorrect, considering the rampant gang violence and my observations on the ground, I believe I am far from mistaken.