The Battle For the Consumer

Topic Category: Business

The Battle for the Consumer

Today, I came across an article in the Financial Times discussing the challenges faced by alcohol companies, which are now grappling with surplus stock due to a decline in consumer demand across all categories. The article highlighted various factors—including income, inflation, and changing tastes—that contribute to this trend. This prompted me to share my perspective on the fundamental dynamics of supply and demand in our rapidly evolving world.

Consumer Choice

In 2004, American psychologist Barry Schwartz published a fascinating book titled The Paradox of Choice, which I read a couple of years ago. In it, he poses the question of whether having more choices actually makes us happier as consumers. He reminisced about his experience purchasing jeans in the 1980s, where a simple request for regular jeans was straightforward. Fast forward to the 2000s, and that same request now invites a plethora of options, such as regular, skinny, or bootleg cuts. Schwartz noted that this overwhelming array of choices often leads to anxiety, as consumers fear making the wrong decision with limited resources at their disposal.

He observed that while economists typically assume that more choices equal better outcomes, this isn't always true when consumers face an abundance of options within the same category, leading to choice paralysis. Fast forward to 2026, and the situation has escalated exponentially; we now face not only a vast selection of products but also various purchasing methods, transitioning from traditional brick-and-mortar stores to digital platforms that allow for shopping on the go or from the comfort of our homes using smartphones.

In addition to these countless options, there has been a shift in marketing channels. Previously, large corporations dominated the market with significant budgets that controlled media narratives. Now, social media enables smaller players to enter the market, innovate independently, and capture market share, sometimes at the expense of industry giants. Furthermore, every market has seen an increase in complementary goods, complicating purchasing decisions. For example, while alcohol companies once only had to consider cigarettes as complementary products, they now also face a $35 billion vaping industry that adds complexity to consumer choices.

The key takeaway is that consumers now have a seemingly infinite array of purchasing options and multiple channels to make those purchases, complicating consolidation for large corporations.

Consumer Income

Now that we understand the array of choices consumers face, we must also consider the incomes they are working with.

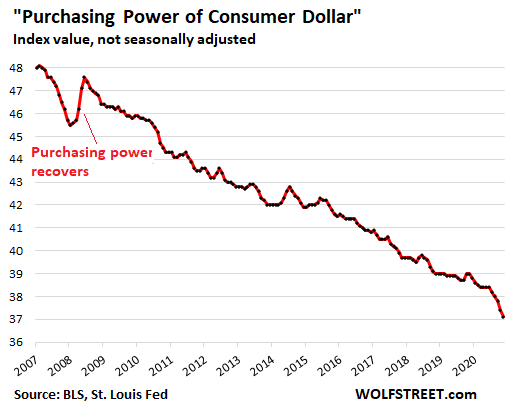

Firstly, let's look at a graph illustrating consumer purchasing power over time:

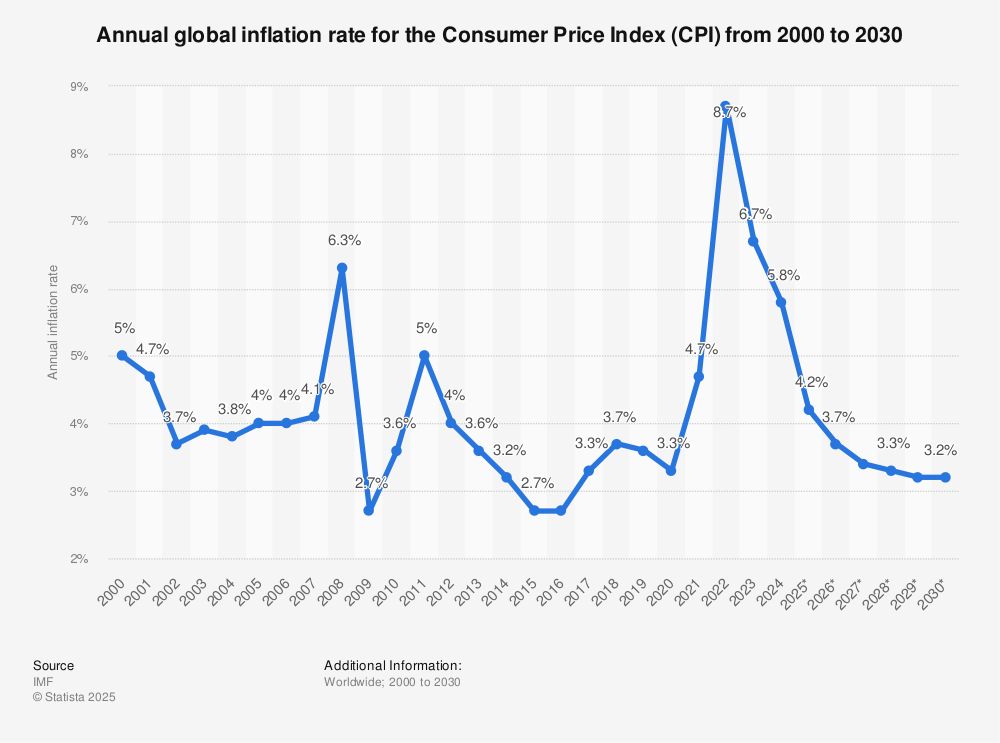

And another graph showing the inflation rate for the Consumer Price Index over time:

In simple terms, these graphs indicate that consumer purchasing power has significantly decreased amidst rising inflation. Compounding this issue, incomes have not been adjusted in real terms to account for the simultaneous increases in inflation and the decline in the purchasing power of currency.

This situation means that consumers today face an overwhelming number of choices and reduced real incomes in a world where the cost of goods continues to rise. To illustrate this, consider the rising prices of cars, education, gasoline, housing, and iPhones.

When you combine these pressures, it becomes clear how strained today's consumers are. Even though inflation is projected to decline according to the IMF, we know that "prices are sticky downwards." This economic term refers to the reality that companies generally do not lower prices. Consequently, the automobile industry has experienced upheaval, with the rise of Chinese cars leading to a shift away from formerly trusted German brands that have lost market share due to their high pricing strategies and refusal to lower prices.

Consumer Demand

So, what does all this mean for consumer demand? It signifies that with an increase in choices and reduced incomes, consumer demand becomes fragmented and unpredictable. While this may not have significant implications at a micro level, the macro-level consequences can be disastrous, potentially leading to the downfall of major companies. Traditionally, large corporations and established media had a monopoly on defining what is "cool" or worth purchasing. However, with the rise of digital media, capturing consumer attention has become increasingly challenging, especially in a landscape characterized by shrinking attention spans, creating greater distance between companies and consumers.

As a result of these changes, big corporations have been compelled to adapt and adjust their budgets, often leading to reduced staffing and marketing expenditures. Consequently, they are adopting a "spray and pray" approach in trying to engage consumers, who are now more conscious of their spending.

Consumer Switching

The Substitution Effect

The change in consumption due to a change in the good's price relative to other goods, while keeping real income constant.

Example: If coffee prices rise, consumers may buy more tea (a substitute); if coffee prices fall, they opt for more coffee and less tea.

The Income Effect

The change in consumption resulting from a shift in a consumer's real income (purchasing power) due to a price change, while keeping relative prices constant.

Example: For an inferior good (like instant noodles), a price increase might make consumers feel poorer, leading them to buy less. Conversely, a price drop may make them feel wealthier, prompting them to buy even less as they switch to higher-quality goods.

These two effects illustrate how income and the price of goods influence consumer purchasing decisions. Consequently, we are witnessing ongoing trends that will continue to challenge the bottom lines of companies, especially those unwilling to adapt to the evolving consumer landscape.

A Message for Corporations

The message is clear and straightforward: the very consumer you aim to attract is also targeted by your competitors. Take into account the pressures consumers are under and begin offering greater value through rewards or incentives to foster loyalty. Continuously bombarding consumers with excessive marketing won’t resonate in a fragmented world that is moving at such a rapid pace. Perhaps the world needs a comprehensive economic reset or a macro slowdown; however, from my perspective, companies seem intent on squeezing every last drop from their customers.

In order to thrive, companies must provide consumers with more value than they are willing to pay or risk losing them altogether. This is particularly relevant for brands like Apple, which may need to reconsider their pricing strategies or halt the release of new phones that are virtually identical year after year. How long they can maintain this trend before facing market repercussions remains to be seen.